december child tax credit 1800

So for example if. This means a family can get a payment of up to 1800 for.

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

However the deadline to apply for the child tax credit payment passed on November 15.

. The deadline to file a simplified return and sign up for CTC payments is November 15. Pasja1000 Pixabay In November The IRS launched a new tool that will allow any family receiving monthly Child Tax Credit payments to update their income using the Child Tax Credit Update Portal known as CTC UP found exclusively on the IRSgov website. Typically families get up 300 per child - but some will get more this month.

If you opted out of partial payments before the first check went out youll get your full eligible amount with your tax refund -- up to 3600 per. To opt out you need to do so by tomorrow Thursday Nov. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17.

However theyre automatically issued as monthly advance payments between July. The amount you are paid in a lump sum this year depends on what you qualified for and received between July and December last year. There is one group of people who are eligible to receive the entire lump sum payment of up to 1800 in Dec.

Eligible families will receive up to 1800 in cash through December however the tax credit has a wrinkle that may prompt some families to bypass the federal program. Non-filers who did not file taxes in 2019 or 2020 due to a low enough income can still claim the payments. When does the Child Tax Credit arrive in December.

For the child tax credit payments. Its possible to get 1800 for the December child tax credit payment heres how. The portal intended to make it easier for families to receive monthly child tax credit payments as well as any stimulus checks they may be eligible to receive.

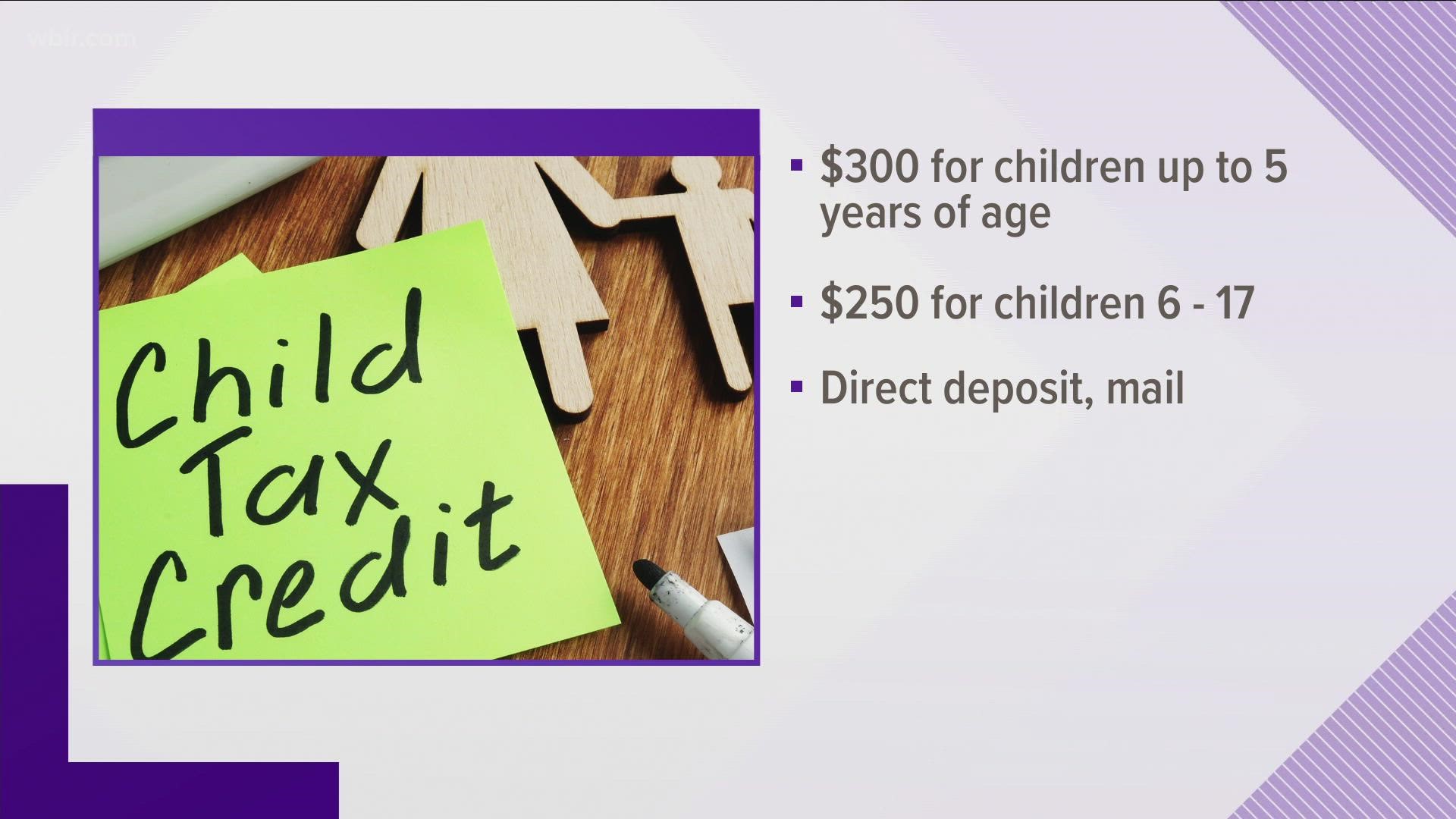

Its possible to get 1800 for the December child tax credit payment heres how. The expanded child tax credit provides up to 3600 for each child age 5 and under and up to 3000 for each child age 6-17 with half payable in six monthly installments of. Child tax credit payments went out automatically starting in July to families who had their tax return details on.

Those who signed up will receive half of their total child tax credit payment up to 1800 as a lump sum in December. To qualify for the full payments couples need to make less than 150000 and single parents who file as heads of households need to make under 112500. Thousands of families will get an extra 1800 in Child Tax Credit money next month.

The payment could be as much as 1800 for each child five years old or younger and up to 1500 for each child 6 to 17 years of age. The final monthly child tax credit payment is due to go out on Wednesday. Six months of payments were advanced on a monthly basis through the end of 2021 meaning.

Since payments have been going out since July that would mean. This is the same total amount that most other families have been receiving in up to six monthly payments that began in July. Families who sign up will normally receive half of their total Child Tax Credit on December 15 according to the IRS.

Those families who used the tool to file by last weeks November 15 deadline will then receive all of the 2021 payments on December 15 totaling up to 1800 per child. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. Deadlines for opting in and out of the child tax credit payments are approaching fast.

Specifically theyll get half of the entire child tax credit amount as an advance on December 15. Parents can receive up to 1800 for every child under the age of five and 1500 each for children between 6 and 17. What that means is that tens of thousands of households will receive a December payment of up to 1800 per.

If you have been receiving the Child Tax Credit monthly payments since July you could be given up to 1800 for each child aged five and younger or up to 1500 for each child aged between six. Typically qualifying families receive up to 300 per child per month. The enhanced Child Tax.

This means a payment of up to 1800 for each child under 6 and up to 1500 for each child age 6 to 17. For the child tax credit payments. Staff Report November 10 2021 214 PM.

This means a payment of up to 1800 for each child under 6. While there is no limit for the number of children eligible for the expanded credit there is. The IRS will send the last monthly payment of the Child Tax Credit on December 15.

Families signing up now will normally receive half of their total Child Tax Credit on December 15. The credit is now 3600 annually for children under the age of six and 3000 for children aged 6 to 17. This means a payment of up to 1800 for each child under 6 and up to 1500 for each child ages 6 to 17.

Or youll get one in just December of that full. Typically families get up 300 per child - but some will get more this month.

Child Tax Credit Info For Foster Parents Fpaws

The December Child Tax Credit Payment May Be The Last

Advance Child Tax Credit Payments Learn If You Need To Pay Money Back Cnet

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit Info For Foster Parents Fpaws

New Stimulus Payments Arrive This Week Some Families Will Get 1 800 Here S Why Woai

Child Tax Credit Delayed How To Track Your November Payment Marca

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

December Child Tax Credit What To Do If It Doesn T Show Up Wusa9 Com

Child Tax Credit Info For Foster Parents Fpaws

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Irs Child Tax Credit Payments Start July 15

Child Tax Credit Payment Dates For Final 300 Lump Sum Of 1800 Itech Post

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Child Tax Credit January 2022 When Could Ctc Payments Start In 2022 Marca

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Cbs News

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Child Tax Credit December Payment Will See Some Families Get 1 800 Per Kid In Just 4 Days Are You Eligible

Biden Wants To Extend The 3 600 Child Tax Credit Through 2025 Kiplinger